Announcing Matrix XII: An $800M fund to invest from concept to Series A Read more

The full overview of the Matrix FinTech Index is available on TechCrunch here.

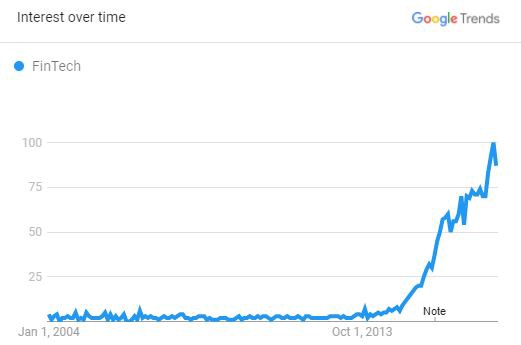

Over the course of the last few years, FinTech as a category has really taken off. Five years ago the term ‘FinTech’ was not something most people had heard of other than a few early players in the startup ecosystem.

Today, FinTech is ubiquitous. In fact, the term has become synonymous with innovation in financial services — it’s hard to imagine a world without Paypal, Venmo, Square and many others. The Google Trends chart below describes this explosion in FinTech interest best.

Definition: Matrix considers “FinTechs” to be (a) technology-first companies that leverage software to compete with traditional financial services institutions (e.g. banks, credit card networks, insurers, etc.) in the delivery of traditional financial services (e.g. lending, payments, investing, etc.) or (b) software tools that better enable traditional finance functions (e.g. accounting, point-of-sales systems, payments, etc.)

With an eye towards tracking the progress of disruption in the financial services space, we’re excited to release the Matrix U.S. FinTech Index today.

This market-cap weighted index tracks the progress of a portfolio of the 10 leading public FinTech companies over the course of the last year (beginning in December of 2016). For comparison, we have also included another portfolio of the 10 largest financial services incumbents (companies like JP Morgan, Visa and American Express) as well as the S&P 500 index.

As seen below, the Matrix FinTech Index shows a clear win for the FinTechs, who have collectively delivered 89% returns in the last 12 months. This is 60 percentage points higher than the 29% returns delivered by the incumbent portfolio and well above the S&P 500 Index.

Our hope in the coming months is to provide periodic updates to this Index. In addition, we are releasing a data package that anyone can download here that has a range of other helpful information on both the FinTechs and the incumbents. More specifically, the package includes:

Finally, this index is dynamic — we fully anticipate that it will be tweaked and refined in the coming months. Please feel free to send us your thoughts and feedback as we refine the process and methodology.

159

1